Goal Setting:

The “Why” Will Direct the “What” and “How”

One of the biggest ironies when it comes to goal setting for financial planning is that most people do not set goals because they have a fear of failure, yet studies show that people who simply write down their goals are more likely to achieve them than people who do not write them down.

I can see how the fear of failure can creep in when the internet is littered with “experts” who tell you they have the secrets on how you can “Level up!!”, or “2X your portfolio!!” and my favourite; “Crush it!!”

There’s a lot of pressure in these expressions to not only perform, but to be perfect.

Think Intention over Perfection

But perfection shouldn’t be the intention of goals. The intention should be to improve and progress.

The act of setting financial goals:

- provides a roadmap for your savings and investments, ensuring that you’re working towards tangible outcomes, such as buying a home or securing a comfortable retirement.

- helps in prioritizing expenditures between “present” you and “future” you. This can lead to more disciplined spending and saving habits.

- allows for tracking progress and making informed adjustments along the way, which is essential for adapting to life’s inevitable financial changes and challenges. These practices contribute significantly to overall financial well-being and security.

Only you can judge

Only you can judge

Financial goal setting is a very personal pursuit. You are the only person who can judge your goals. There are no good or bad goals. Yes, many people want to know things like when they can retire or how much they can spend in retirement, but the reasons why they want to know the answers can vary.

“What” then “Why” then “How”

When you first start to write your goals, don’t get too hung up on “How” to achieve these goals in the early stages. The “How” will be developed over time by analyzing you cash flow regularly. (See my article on why budgets don’t work here.)

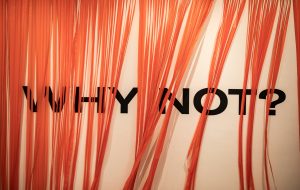

Your objective is to first choose “What” you want your goals to be, and most importantly “WHY” you want to achieve them.

Conclusion

Don’t let perfection or failure discourage you from writing out your goals and beginning your financial planning journey. I’ve included a goal setting checklist and worksheet below for you to download and begin your financial planning process. Update them regularly.

If you need help in finding your financial “What”, Why” and “How”, reach out to schedule a free, no obligation call with David to begin on your path to improving your financial well-being (calendar booking link here).

Download: Goal Planning Checklist

Download: Goal Planning Worksheet

David Martin is an Advice-Only Financial Planner in Halifax NS, serving Atlantic Canada DIY investors and business owners.

Connect with David on LinkedIn.

Disclaimer: Our content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment and tax-related decisions. You should seek independent financial advice from a fiduciary, if possible.