CPP and OAS Starting Age

Mistiming the Start Dates of these Government Benefits can Help or Harm your Retirement Plans

Who doesn’t want “free” money from the government?

If you’ve ever looked at your pay stub or tax return, you know that the Canada Pension Plan (CPP) and Old Age Security (OAS) pension benefits you might be eligible to receive in retirement aren’t exactly “free”. But that doesn’t stop people from making rash decisions and beginning their government pensions as soon as they become eligible.

When to start CPP and OAS

As a financial adviser, I understand the importance of making informed decisions about retirement planning. It can mean thousands of dollars of more monthly income in retirement, and hundreds of thousands of dollars more that you can leave to your loved ones when you pass.

{If you are considering applying for either CPP or OAS within the next year and unsure if now is the best time to do so, I have developed a checklist that others have found useful. If you want to skip reading this rest of this, contact me to request a copy of the checklist. I hope it helps. For more perspective on CPP and OAS, please read on.}

For many Canadian families, Canada Pension Plan (CPP) and Old Age Security (OAS) benefits will represent an important source of guaranteed income in retirement. Deciding when to begin taking these benefits is a significant decision that requires careful consideration.

As a matter of fact, of the hundreds of Canadian families I have met and worked with in my career, I would say the most common question I get is regarding the timing of CPP/OAS benefits. Optimizing the lifetime value of these government benefits is a key component of your effective decumulation and estate planning strategies.

What is CPP? OAS?

What is CPP? OAS?

Briefly, the CPP is a contributory, earnings-related social insurance program. You can begin taking CPP benefits anytime between ages 60 to 70. It provides partial replacement of earnings in the case of retirement, disability, or death.

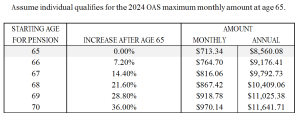

The OAS is a residency-based pension program. To qualify, individuals must be Canadian citizens or legal residents and have lived in Canada for at least 10 years after turning 18. You can begin taking OAS between the ages of 65 and 70.

Both CPP and OAS are considered taxable incomes when received. However, only OAS is subject to a recovery tax if the recipient’s net annual income exceeds a certain threshold. There are also supplementary benefits available under the OAS program, including the Guaranteed Income Supplement (GIS) and the Allowance and Allowance for the Survivor, which provide additional financial support to eligible low-income seniors.

I’ve seen too many financial and retirement plans use estimates for CPP and OAS benefits, which can over- or under-represent an accurate picture of your retirement. Over-representing your retirement can be dangerous as you might find yourself forced into making risky financial decisions when you can least afford to. (Please, do yourself a favour and create a My Service Canada account on the Government of Canada’s website where you can find accurate information regarding your projected CPP and OAS benefits.)

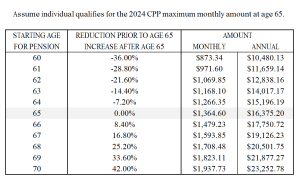

The standard age to begin receiving CPP is the month after your 65th birthday, but you can elect to take a reduced pension as early as age 60 or an increased pension as late as age 70. For each month you take CPP before age 65, your pension amount will decrease by 0.6%, which equates to a 7.2% reduction per year. This is a permanent reduction, so it’s crucial to weigh the immediate need for income against the long-term benefits of waiting.

Some Pros and Cons of Taking CPP Early

Pros:

- Immediate Income: For those who retire early or have pressing financial needs, taking CPP early can provide a necessary income stream.

- Bridging to Other Benefits: Early CPP can serve as a bridge until other retirement incomes, like private pensions, become available.

- Health Considerations: If you have health issues or a family history of shorter life expectancy, taking CPP early ensures you benefit from the program while you can.

- Preservation of Savings: With early CPP payments, you may reduce the need to draw from personal savings, allowing your investments more time to grow.

Cons:

- Reduced Lifetime Benefits: By taking CPP early, you are accepting a lower monthly amount for life.

- Impact on Survivor Benefits: If you are married, the amount your spouse receives as a survivor benefit will also be lower if you take CPP early.

- Investment Market Dependency in Later Retirement: With a lower lifetime government pension amount in your later years, you will be forced to be more dependent on your personal savings to supplement future

retirement income needs. - Subject to Increased Risk Acceptance: Depending on your needs, you might have to subject yourself to more risk than you are comfortable taking to ensure a meaningful retirement.

Anticipation is Making me Late; Is Keeping me Waiting

On the flip side, delaying the start date of CPP and OAS to after age 65 can have significant financial benefits, so park the FOMO.

For every month you defer taking CPP after age 65, your monthly benefit will increase by 0.7%. This equates to 8.4% more for every year deferred, and a 42% permanent increase if you can wait until age 70 to begin CPP.

The OAS deferral monthly increase is 0.6%, or an increase of 7.2% per yearly deferral. This would be 36% more income annually if you defer your OAS to age 70.

Deferring both CPP and OAS until age 70 can mean a guaranteed indexed pension of approximately $35,000 per year in retirement.

But not everyone can or should defer beginning their CPP and OAS to age 70. Deciding when to start taking CPP and OAS is a complex decision that should be based on your individual financial needs, life expectancy, retirement goals, family structure, risk tolerance, etc.

It’s essential to consider the short- and long-term implications of your choice and consulting with a financial adviser is recommended to assess your specific situation.

David Martin is an Advice-Only Financial Planner in Halifax NS, serving Atlantic Canada DIY investors and business owners.

Disclaimer: Our content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment and tax-related decisions. You should seek independent financial advice from a fiduciary, if possible.