Investment Policy Statements

A Must-Have for DIY Investors

ONE of the 7 key components of your financial plan is your investment portfolio.

(If you’re wondering, the other components are goal setting, cash flow, tax, risk management, estate and business integration.)

Today, we’ll dive into two crucial concepts that can significantly impact your financial future when it comes to your investments: 1) an Investment Policy Statement and 2) Asset Mix.

We’ll explore what they are, why they matter, and how your personal circumstances influence them.

First off: What is an Investment Policy Statement?

An Investment Policy Statement (IPS) is like a personal user manual for your investment portfolio. It outlines your investment goals, strategies, and the guidelines you’ll follow to achieve them. It should be thought of as a personal contract between you and your financial future.

If you have a life partner, you should build your IPS together. I recommend you have your Investment Policy Statement written out or saved as a document so you both can refer to it easily when critical decisions arise.

If you’ve worked with a financial advisor, you most likely have completed a questionnaire that attempts to measure your risk tolerance and return objectives at some point in your relationship. Unfortunately, not many advisors produce a formal IPS, however. (I’ll let you in on an insider’s secret when it comes to most risk tolerance questionnaires from financial institutions below. ⬇️ )

Why is an Investment Policy Statement Important?

Because we are human.

And humans have two very strong emotions that can derail even the most disciplined investor: Fear 😱 and Greed 🤑.

An IPS can:

- keep you focused on your long-term goals, helping you avoid impulsive decisions based on short-term market fluctuations.

- provide a clear framework for making investment decisions, reducing the impact of emotions on your choices.

- help you stay accountable to your financial plans and makes it easier to track your progress.

- ensures you and your life partner (and financial advisor, if you have one) are on the same page about your investment strategy.

What is an Investment Asset Mix?

Your Investment Policy Statement should outline your Investment Asset Mix, also known as asset allocation. It refers to how you divide your investments among different asset classes, such as stocks, bonds, and cash. It’s like creating a balanced meal plan for your money, ensuring you get the right “nutrients” to grow your wealth while minimizing the unhealthy foods that can weigh you down and hold you back.

Your asset mix should be determined by your ABILITY, your WILLINGNESS and your NEED to take risk. Each of these factors combine to determine the most appropriate asset mix for you and your family to reach your financial goals.

(➡️Insider Secret: The financial services industry makes more money selling you stocks than they do selling you bonds. Therefore, most risk tolerance questionnaires focus on either your ability or your willingness to take risk – whichever one leads to you buying more stocks. Your need to take risk is rarely factored in. 🤫)

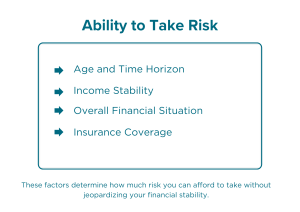

How Does Your ABILITY to Take Investment Risk Affect Your Asset Mix?

Your ability to take risk is about how much risk you can afford to take without jeopardizing your financial stability. If you have a high ability to take risk, your asset mix might include a larger proportion of stocks, which are generally considered riskier but offer potential for higher returns. If your ability to take risk is lower, you might lean towards a more conservative mix with more bonds and cash.

How is Your Ability to Take Investment Risk Determined?

Your ability to take risk is determined by factors such as:

- Your age and time horizon: Younger investors generally have more time to recover from market downturns.

- Your income stability: A steady, reliable income provides a safety net for riskier investments.

- Your overall financial situation: This includes your savings, debt levels, and other financial obligations.

- Your insurance coverage: Adequate insurance can protect you from unexpected financial shocks.

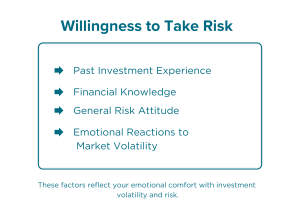

How Does Your WILLINGNESS to Take Investment Risk Affect Your Asset Mix?

Your willingness to take risk is about your emotional comfort with investment volatility. If you’re willing to accept more risk, you might choose an asset mix with a higher proportion of stocks. If market swings make you nervous, a more conservative mix might help you sleep better at night.

How is Your Willingness to Take Investment Risk Determined?

Your willingness to take risk is more subjective and can be influenced by:

- Your past experiences with investing

- Your knowledge about financial markets

- Your general attitude towards risk in other areas of life

- Your emotional reaction to market ups and downs

It’s important to be honest with yourself about how you’d really feel and react during market downturns.

How Does Your NEED to Take Investment Risk Affect Your Asset Mix?

Your need to take risk is about whether you need to pursue higher-risk, higher-return investments to achieve your financial goals. If you need your investments to grow significantly to meet your objectives, you might need to accept more risk in your asset mix.

The opposite is true: If you do not need to take higher-risk, then you should ask yourself is it worth it to take risk.

How is Your Need to Take Investment Risk Determined?

Your need to take risk is determined by:

- Your financial goals: What are you investing for, and how much money will you need?

- Your current savings: How much have you already set aside?

- Your future saving capacity: How much can you continue to save?

- The time frame for your goals: When will you need the money?

If you’ve already saved a significant amount or have modest financial goals, you might not need to take as much risk. On the other hand, if you’re starting late or have ambitious goals, you might need to accept more risk to have a chance of reaching your targets.

When should you update your IPS?

Balancing these three factors – ability, willingness, and need – is key to creating an appropriate asset mix. It’s important to remember that these factors can change over time, so it’s wise to review your IPS and asset mix regularly, such as once a year.

This annual check-in allows you to ensure your investment strategy still aligns with your goals and circumstances.

However, life doesn’t always follow a neat annual schedule. Several factors might trigger the need for an IPS review outside of your regular annual update:

- Major life events: Getting married, having a child, or getting divorced can significantly change your financial situation and goals.

- Career changes: A new job, promotion, or career switch might affect your income, benefits, and financial outlook.

- Windfall or inheritance: Receiving a large sum of money could alter your financial needs and risk profile.

- Health issues: A change in your health or that of a family member might impact your financial priorities and risk tolerance.

- Economic shifts: Major changes in the economic landscape, like recessions or significant market corrections, might necessitate a strategy review.

- Changes in financial goals: Your aspirations might evolve over time. Maybe you’ve decided to retire earlier, or perhaps you want to save for a child’s education.

- Significant market events: While it’s generally advisable not to react to short-term market fluctuations, prolonged or severe market conditions might warrant a review of your strategy.

Remember, the goal of reviewing your IPS isn’t necessarily to make changes, but to ensure your investment strategy remains aligned with your current situation and future goals.

Sometimes, the best action after a review is to stay the course. Other times, you might need to adjust to keep your financial plan on track.

Conclusion

An Investment Policy Statement and a well-thought-out asset mix are powerful tools for achieving your financial goals. They help you stay focused, make informed decisions, and balance risk and return in a way that’s appropriate for your family’s unique situation. While the world of investing can seem complex, understanding these fundamental concepts can set you on the path to financial success.

Remember, everyone’s financial journey is unique. If you’re unsure about your investment strategy or you would like to develop your personal Investment Policy Statement, consider seeking advice from a financial professional who can provide personalized guidance based on your specific circumstances. Preferably someone who doesn’t get compensated by selling you expensive financial products.

If you haven’t already, please read my post on whether you should DIY your financial planning.

David Martin is an Advice-Only Financial Planner in Halifax NS, serving Atlantic Canada DIY investors and business owners.

Connect with David on LinkedIn.

Disclaimer: Our content is intended to be used for informational purposes only. It is very important to do your own analysis before making any investment and tax-related decisions. You should seek independent financial advice from a financial advisor near you.